At the price point of $30,000 per year, a Bloomberg terminal is prohibitively expensive for many investors, but that doesn't mean you can't get the information you need. These great investment research tools will help you get an edge without breaking the bank.

Cost-effective alternatives to a Bloomberg Terminal

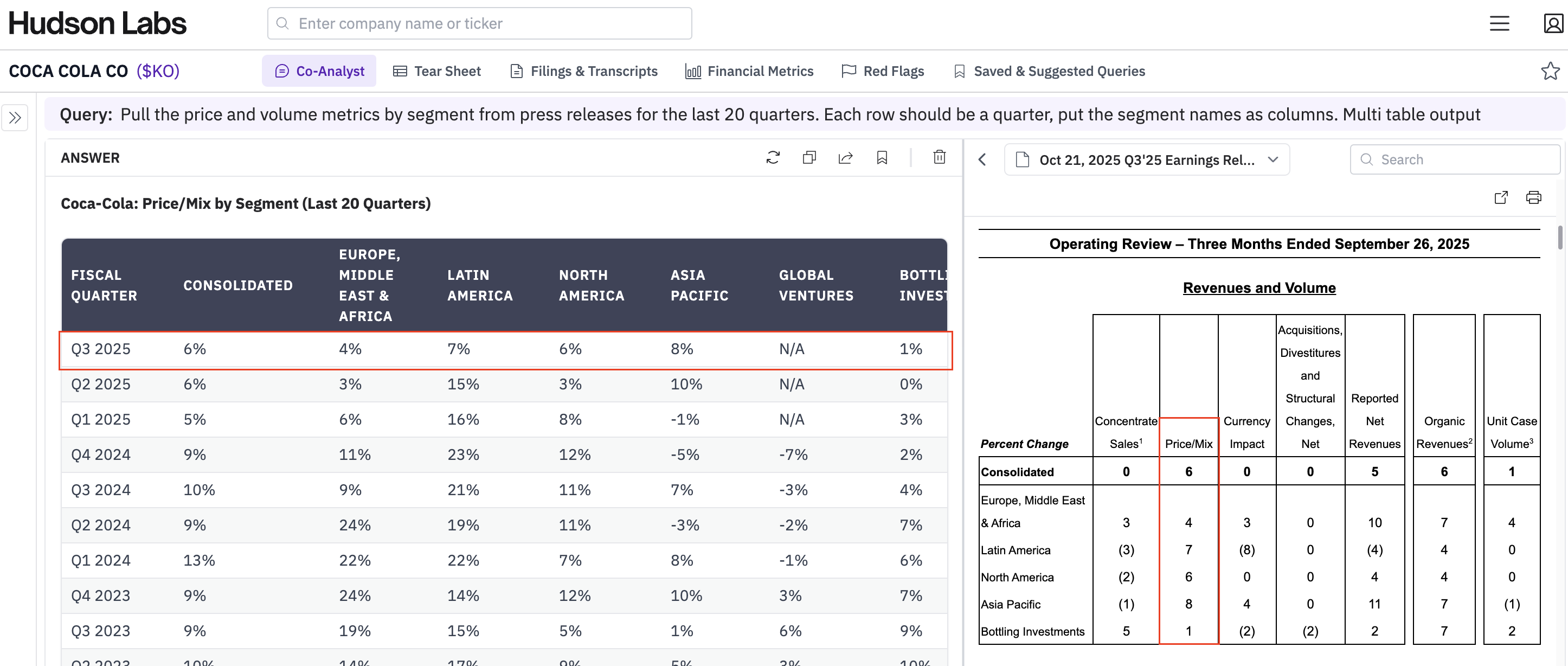

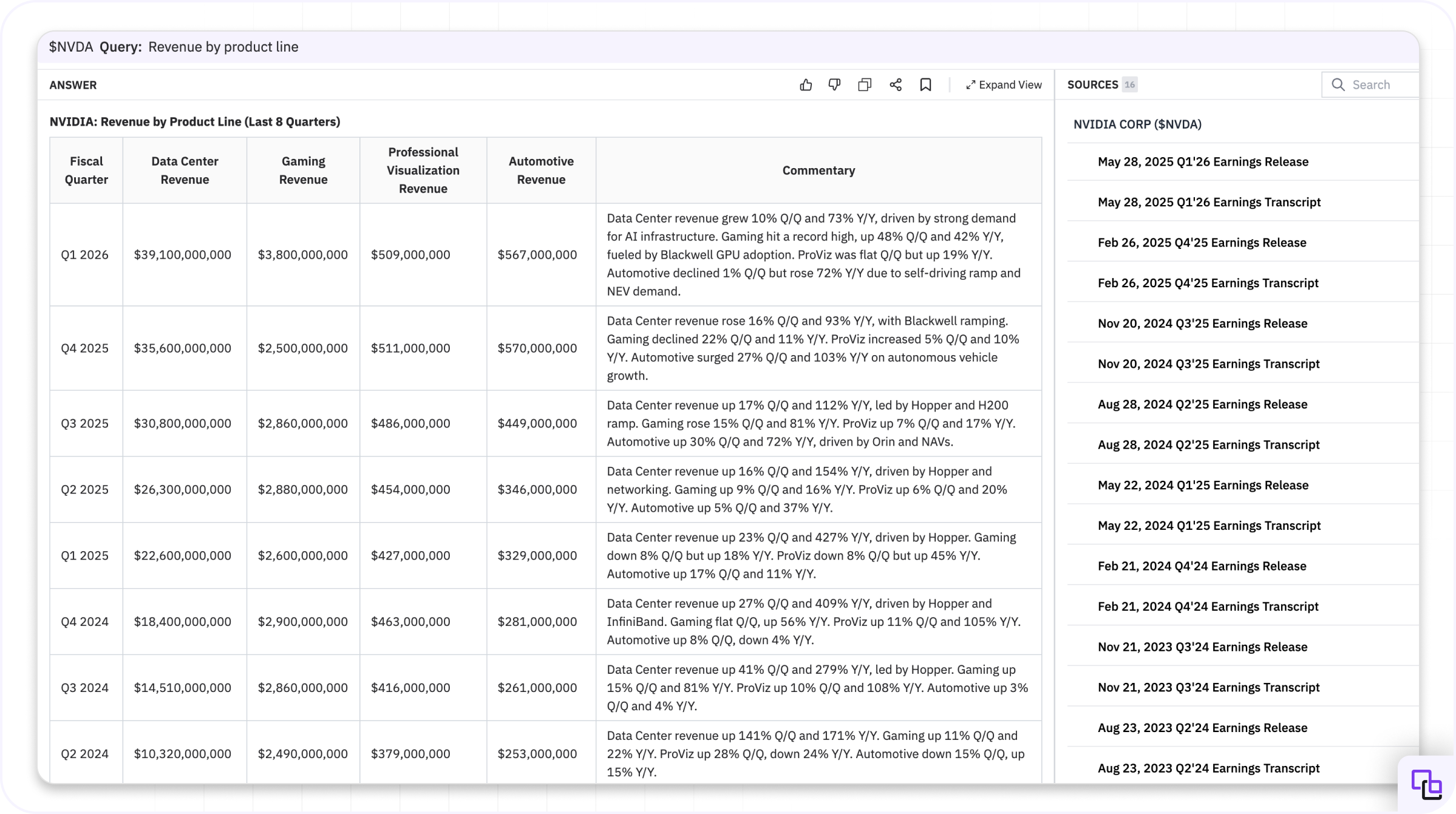

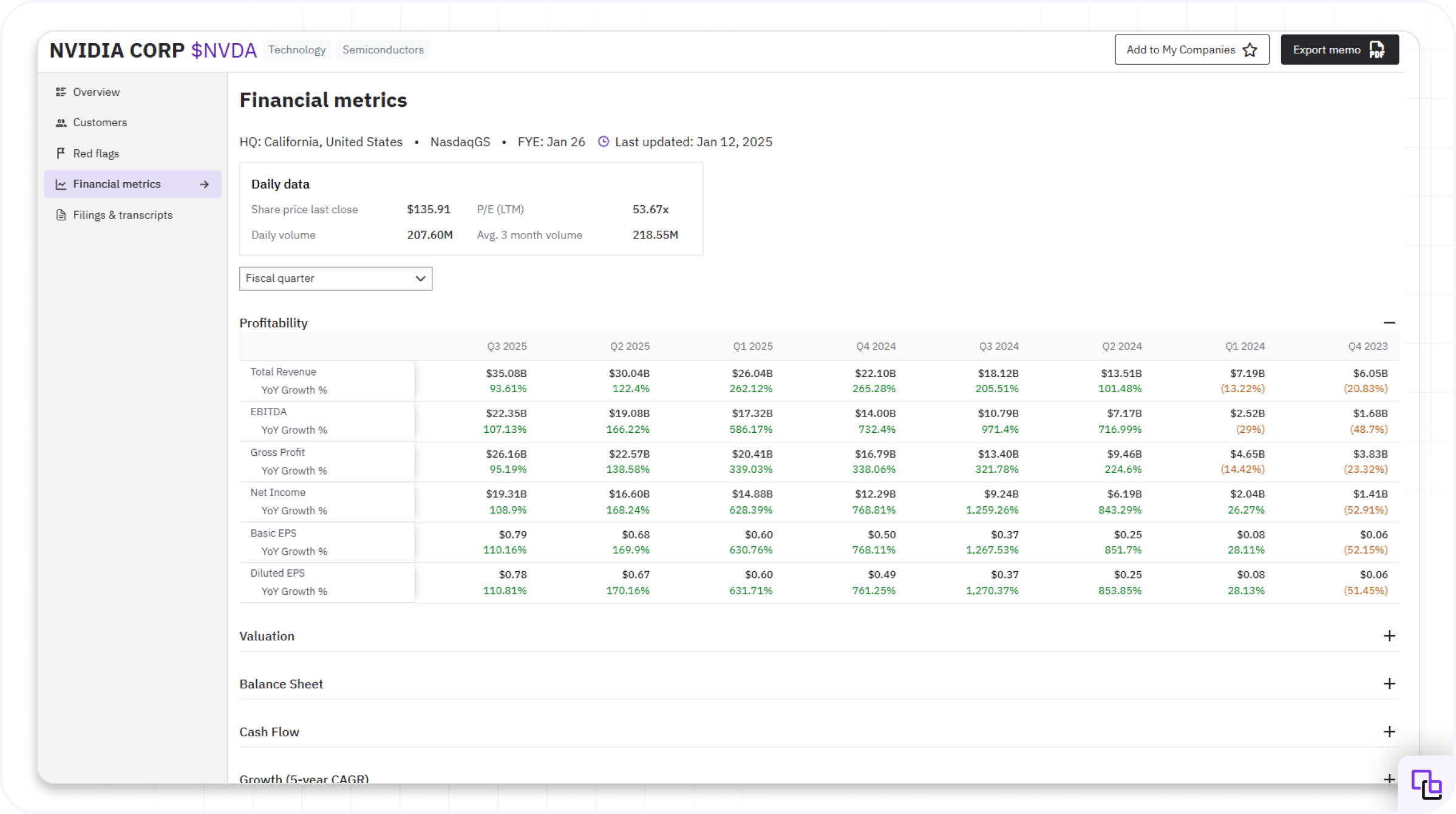

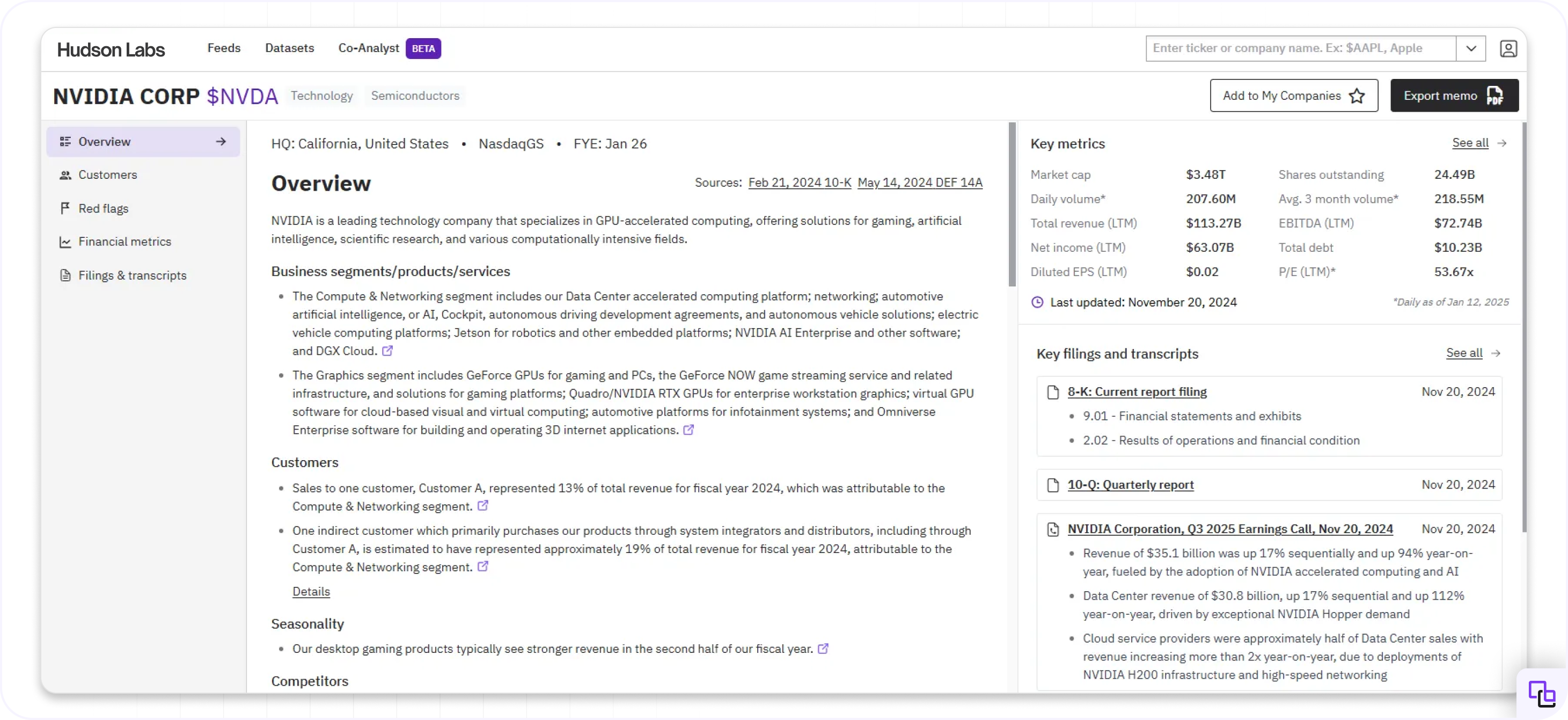

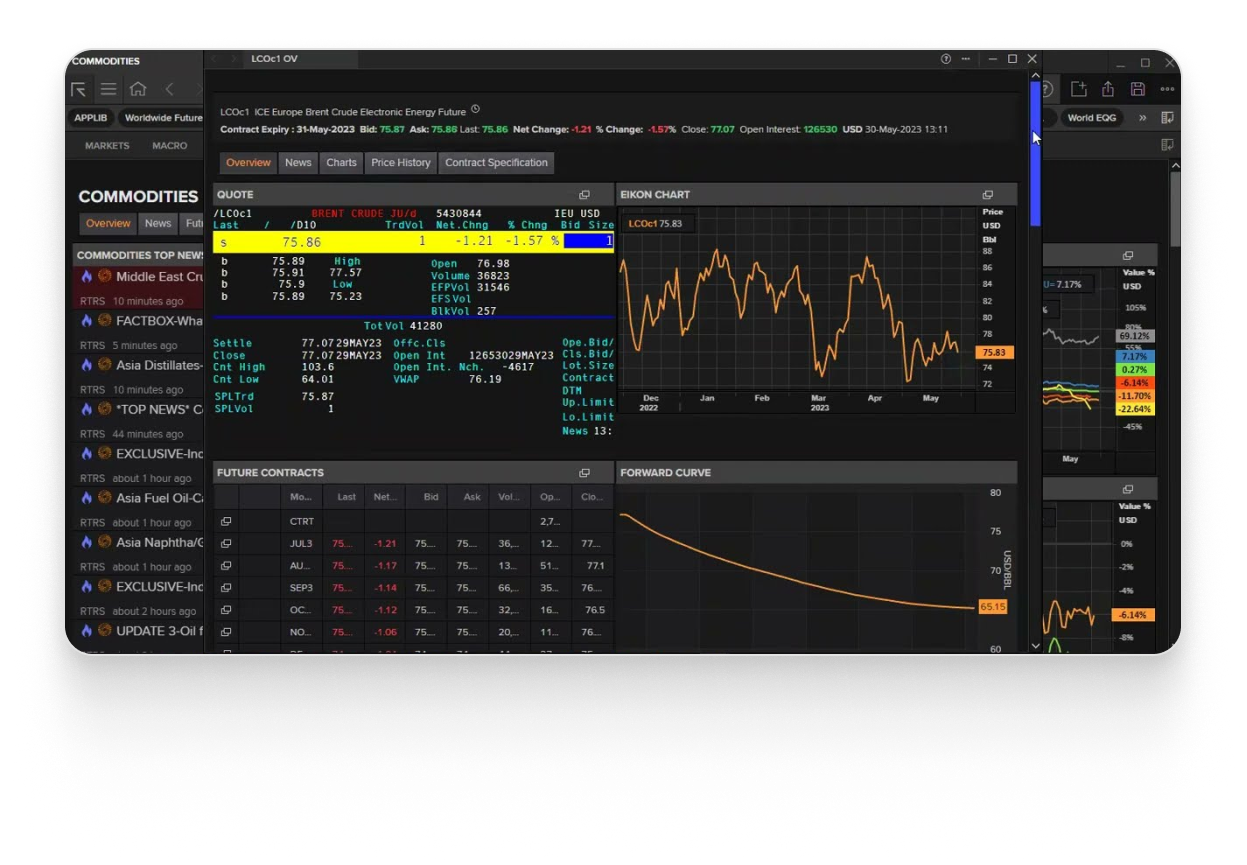

Hudson Labs

The Co-Analyst is a powerful AI tool built for institutional equity research. It can consolidate insights from disparate data sources, generating answers faster and more reliably than any other chatbot out there. It can analyze SEC filings, earnings calls, earnings presentations, and press releases to extract structured insights within seconds. All with no hallucination because of our industry-leading AI infrastructure. Book a trial to try out the Co-Analyst and more:

- Financial metrics

- AI-generated background memos

- AI-identified red flags in SEC filings

- Executive turnover history

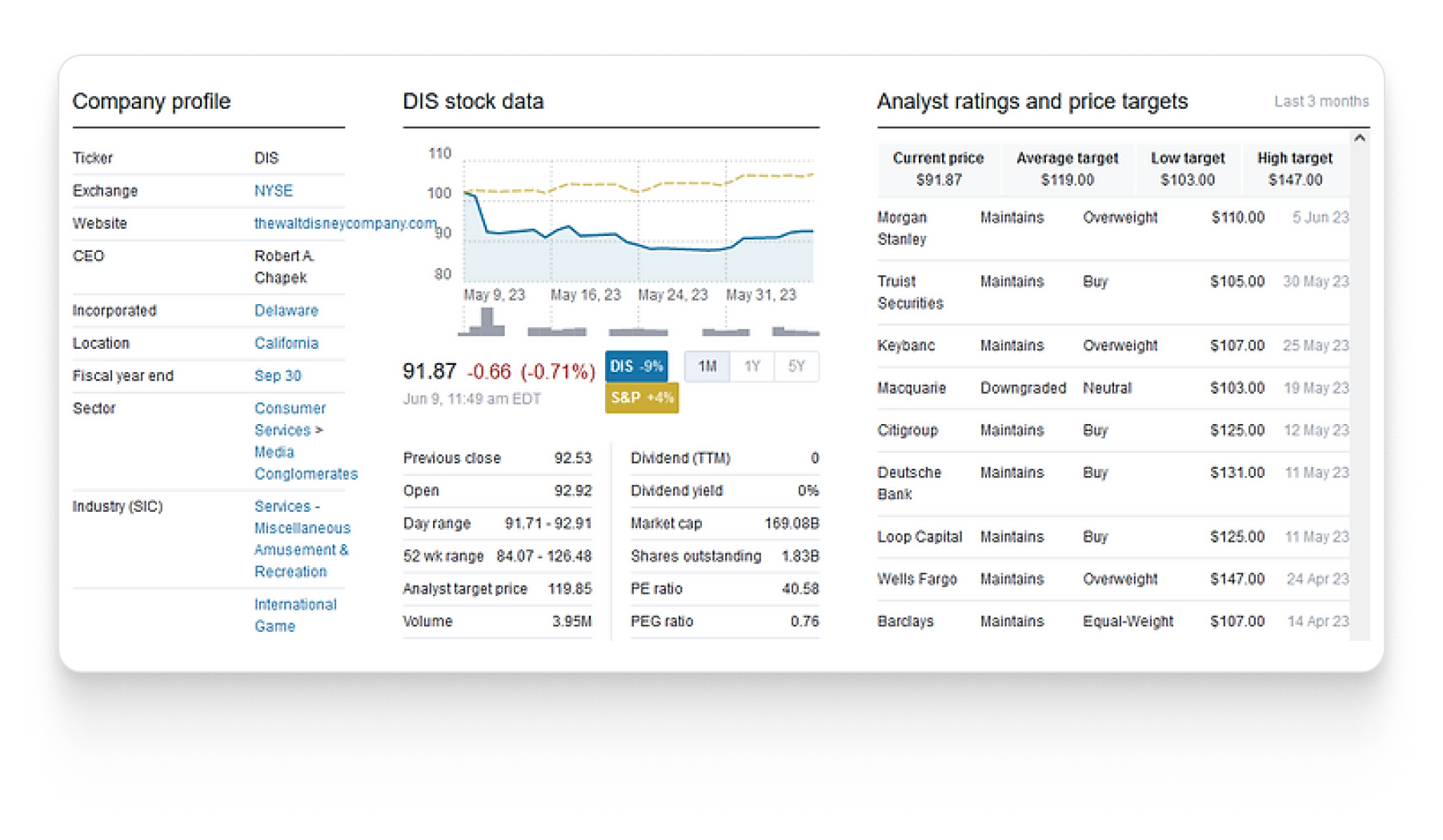

CapEdge

We love CapEdge (formerly Docoh). CapEdge has financial data, SEC filing search, earnings transcripts, market news, stock alerts and charting. It’s all free and has a great user interface.

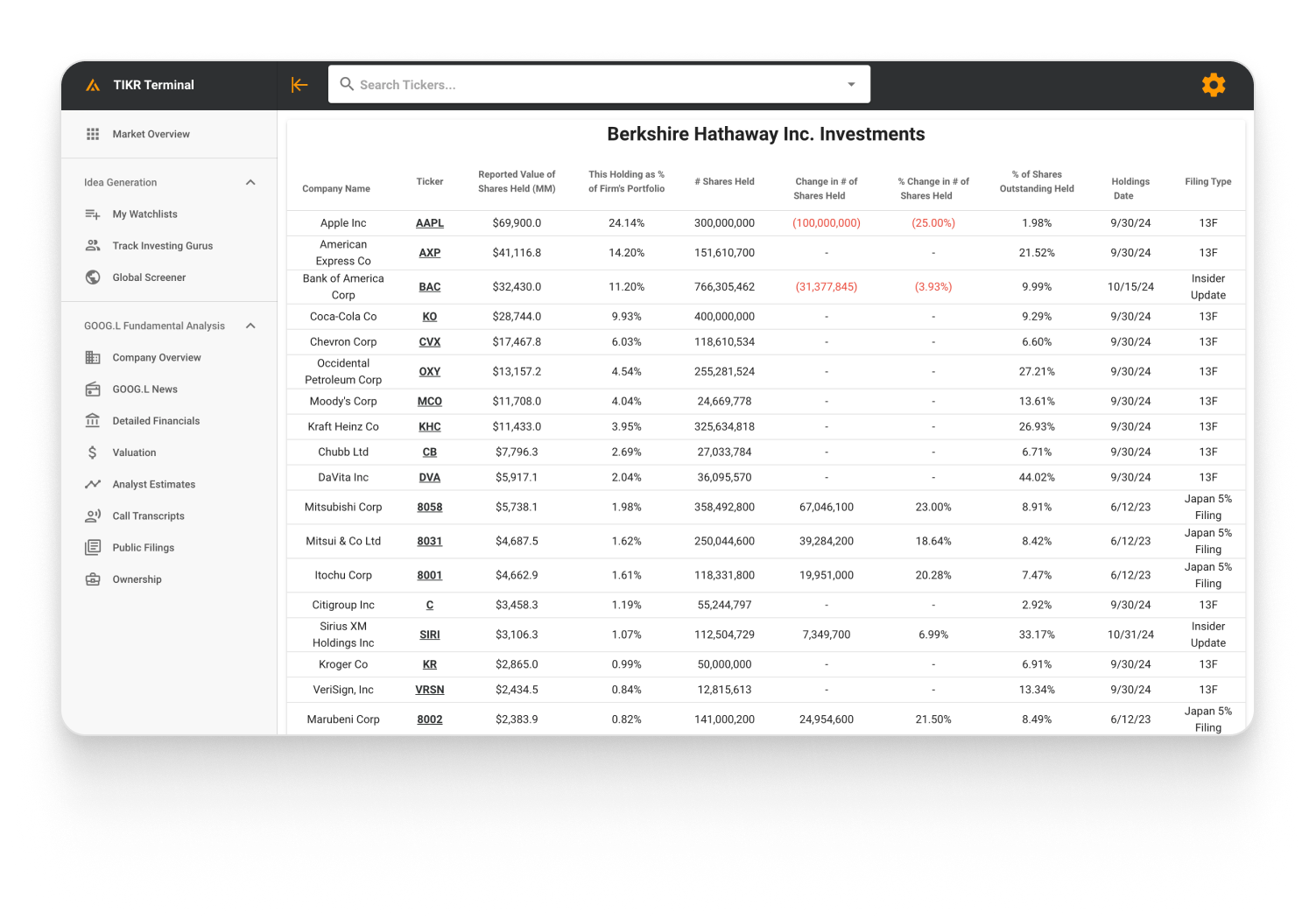

TIKR

TIKR provides financial tools like a stock screener, financial statements analysis, stock valuation metrics, ratios, charts, news, and filings. In addition to the free plan, TIKR offers two other tiers for $19.95 or $39.95.

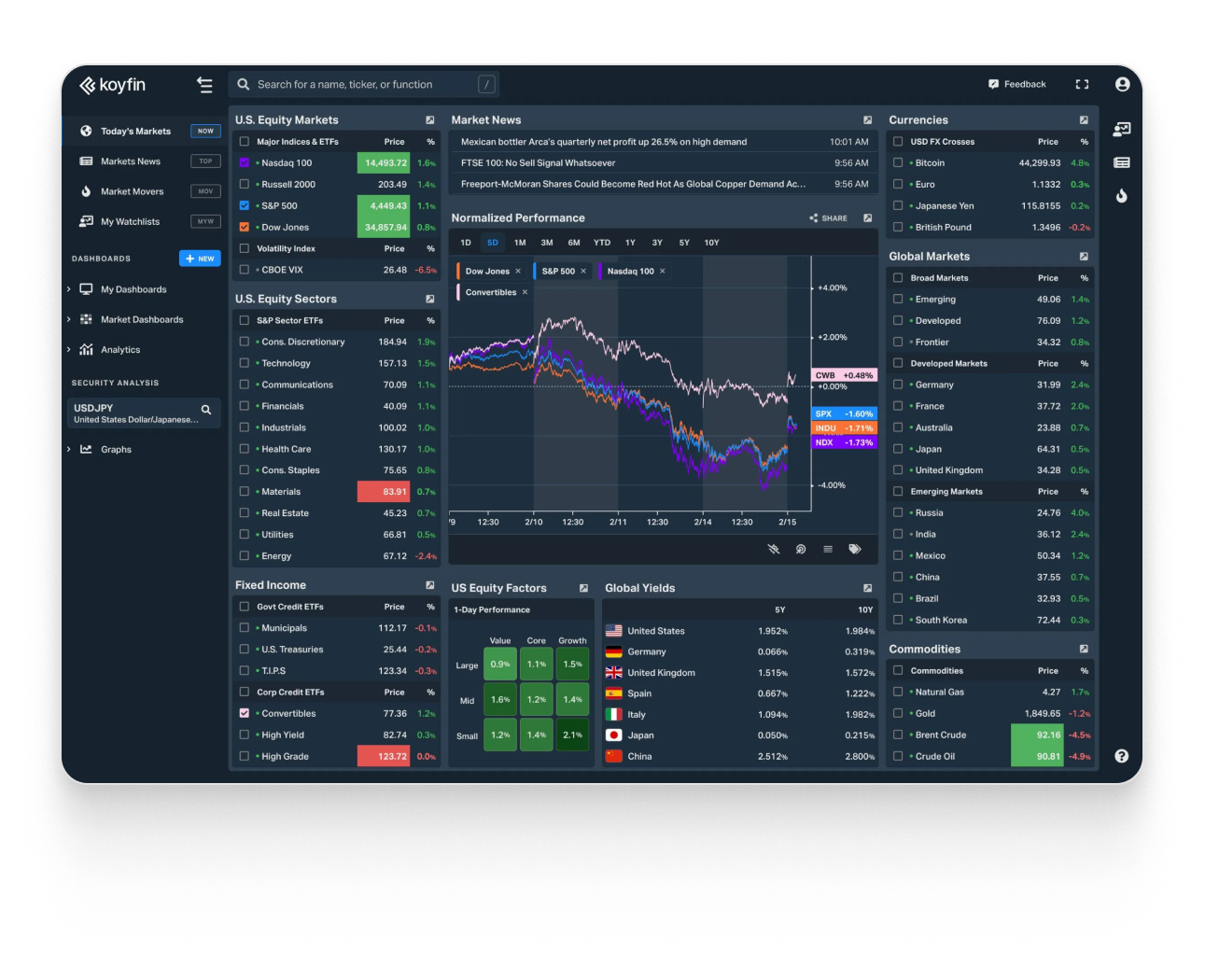

Koyfin

Koyfin is similar to TIKR in many ways. It provides market data, filings, news, charting etc. In addition to their free plan, Koyfin has three paid tiers that cost $49, $110, or $199 per month.

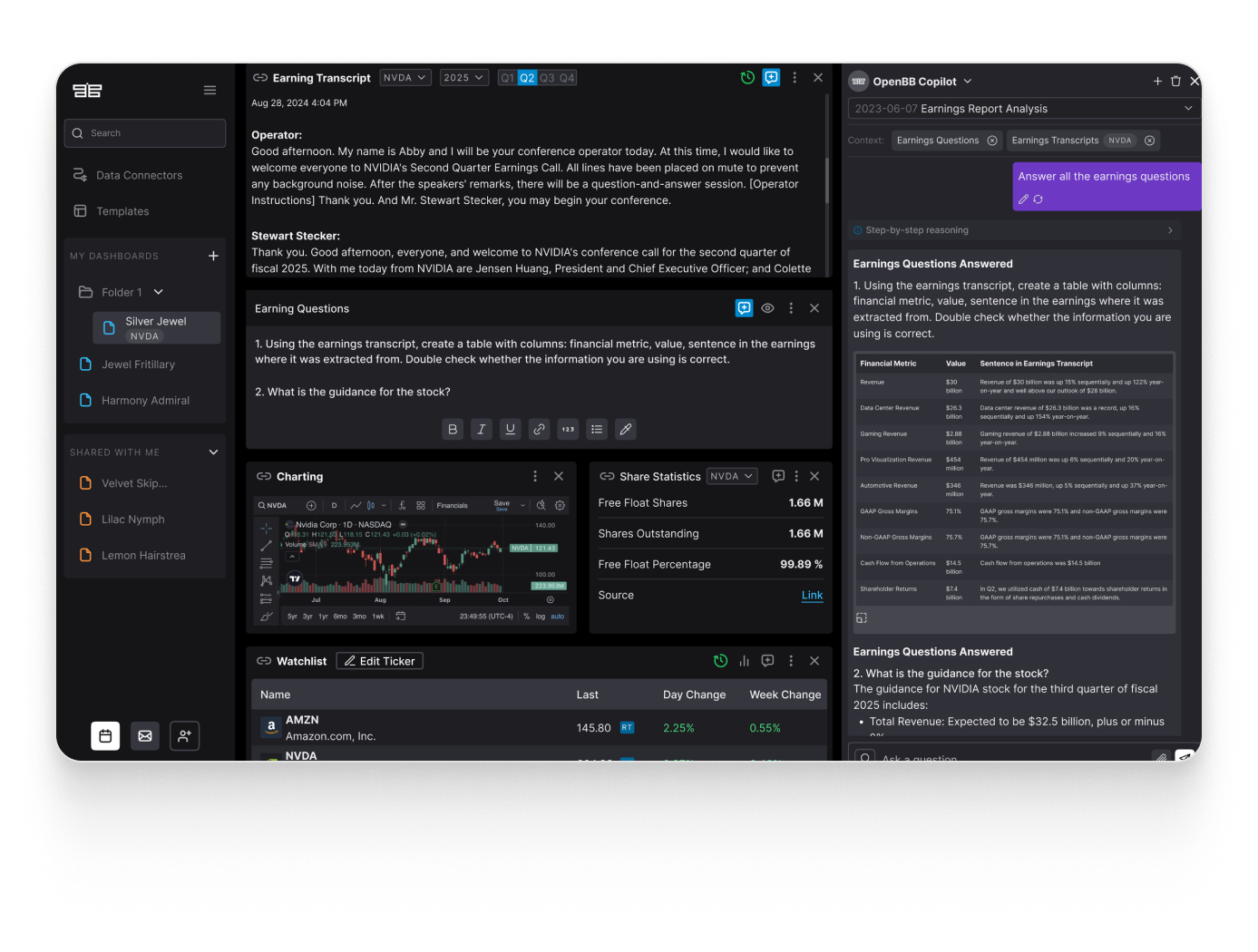

OpenBB

OpenBB is a desktop application with built-in scripting tools (Jupyter notebooks). It allows you to import your own data so you can do forecasting and more. OpenBB has a free plan as well as a paid plan with no price was listed.

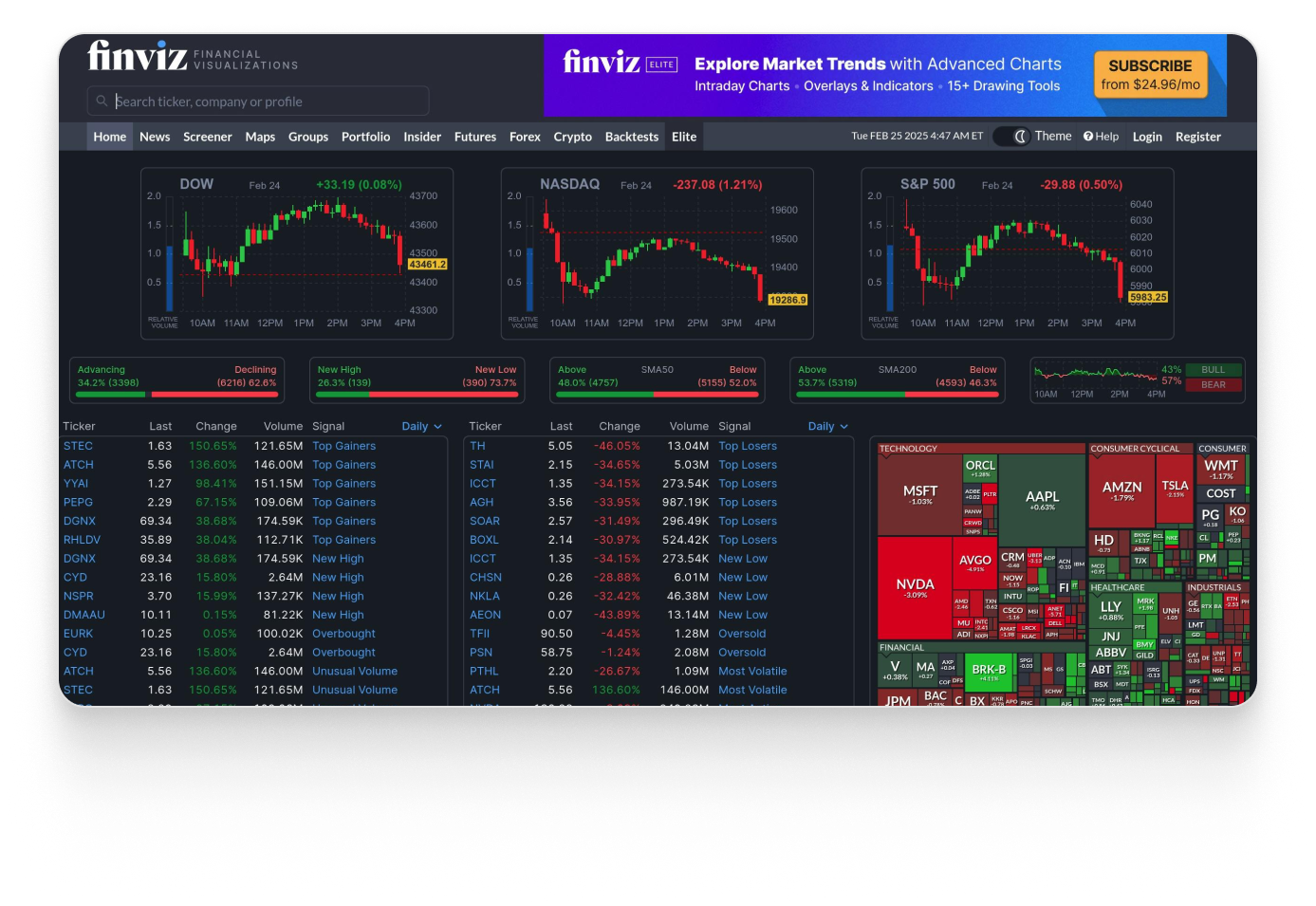

FINVIZ

FINVIZ includes financial news, market heat maps, comparative charts, and sector performance tools. In addition to the free plan there is another option that costs $24.96/mo.

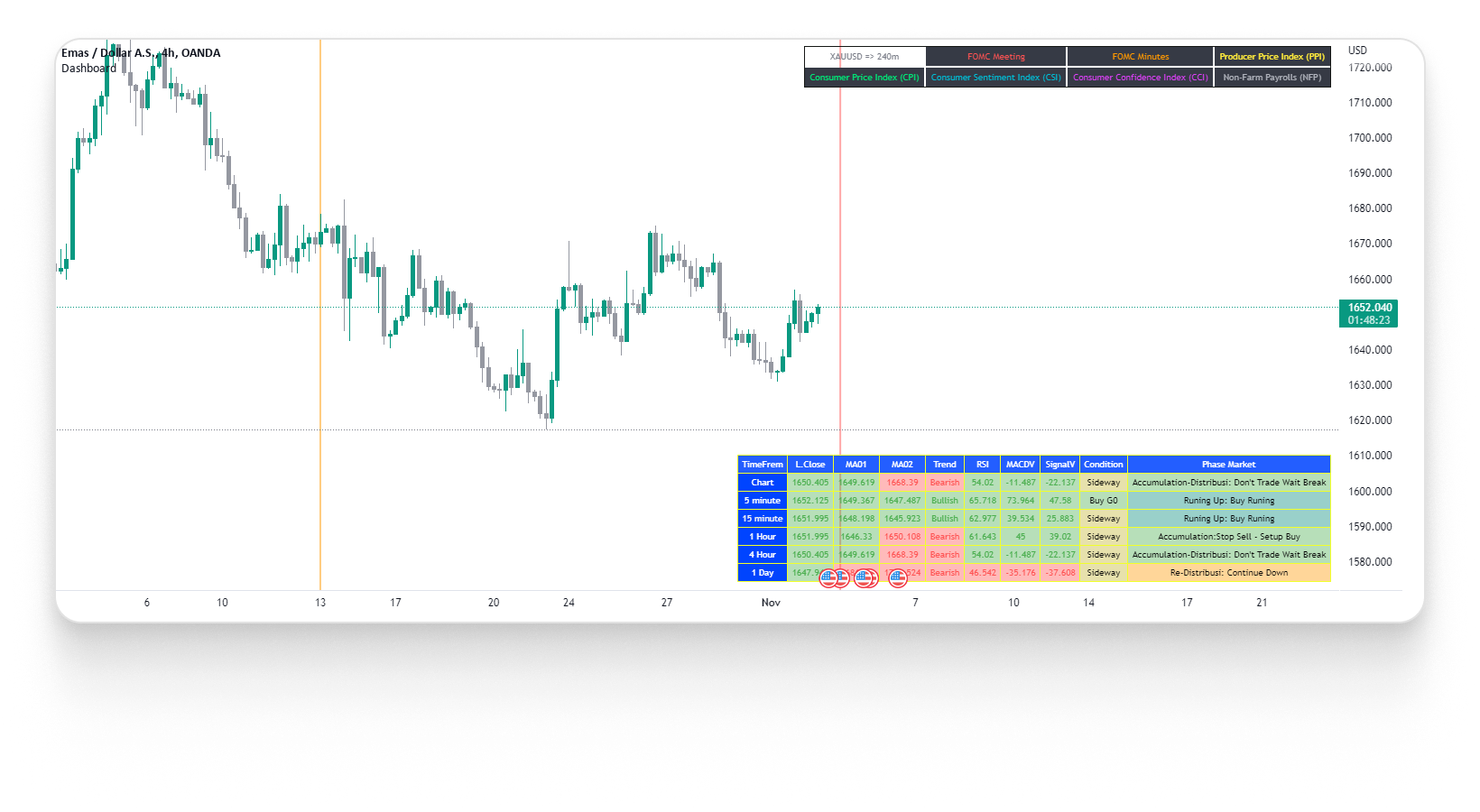

TradingView

TradingView is a stock charting tool with other features including alerts, heat maps, and trading simulations. It also has a stock screener. Trading view offers three plans at $14.95, $29.95 or $59.95 per month. Each has a 30 day free trial.

Tiingo

Tiingo offers free screening and portfolio monitoring. Tiingo is best known for its API. The paid version of Tiingo costs $30/mo.

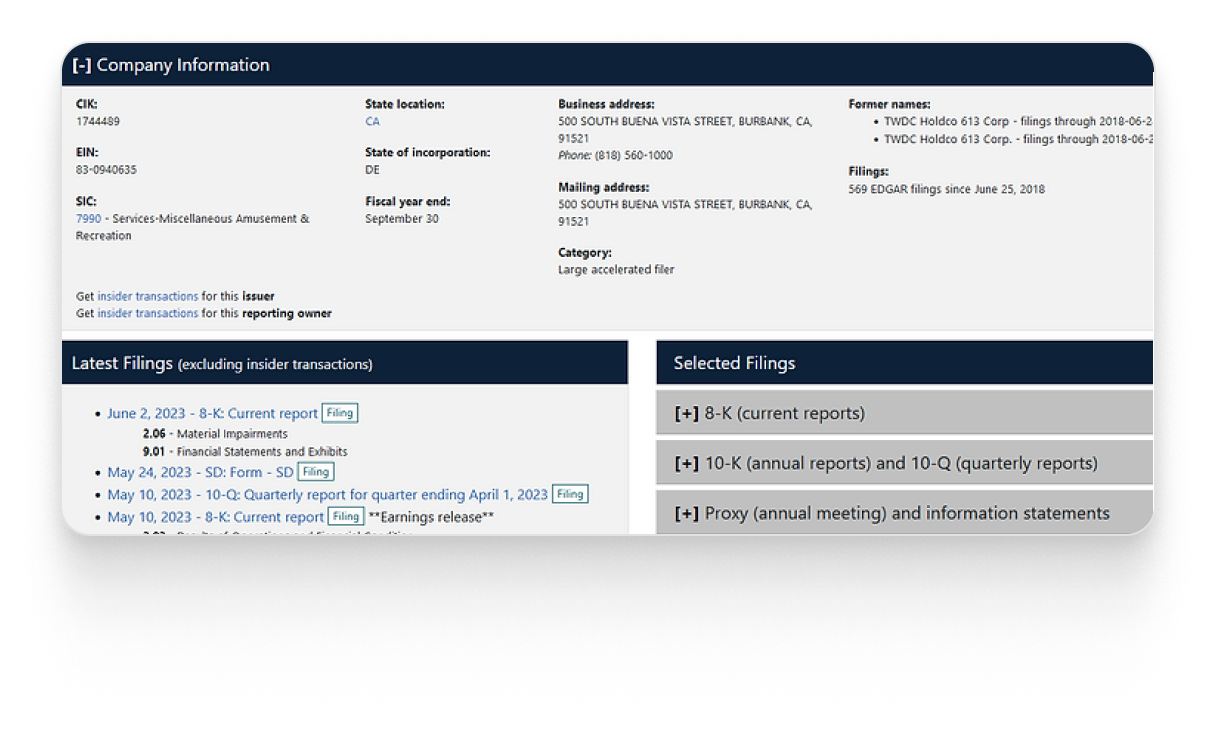

EDGAR

Company-reported financial and transactional data is reported to the SEC through the Electronic Data Gathering, Analysis, and Retrieval system (EDGAR). You can find full financials, XBRL metadata, insider transaction information, prospectuses and more. EDGAR also provides full-text search. EDGAR is free but not trivial to scrape. Refer to the Financial APIs section for programmatic resources. EDGAR is a government-hosted resource that is provided for free.

Top paid financial intelligence software options

Bloomberg

The Bloomberg terminal provides financial and market data, news feeds, messaging, and trade execution services. Most Bloomberg setups have between two and six displays. It is available for an annual fee of $24,240 per user ($27,660 per year for firms that use only one terminal), leased out in two-year contracts.

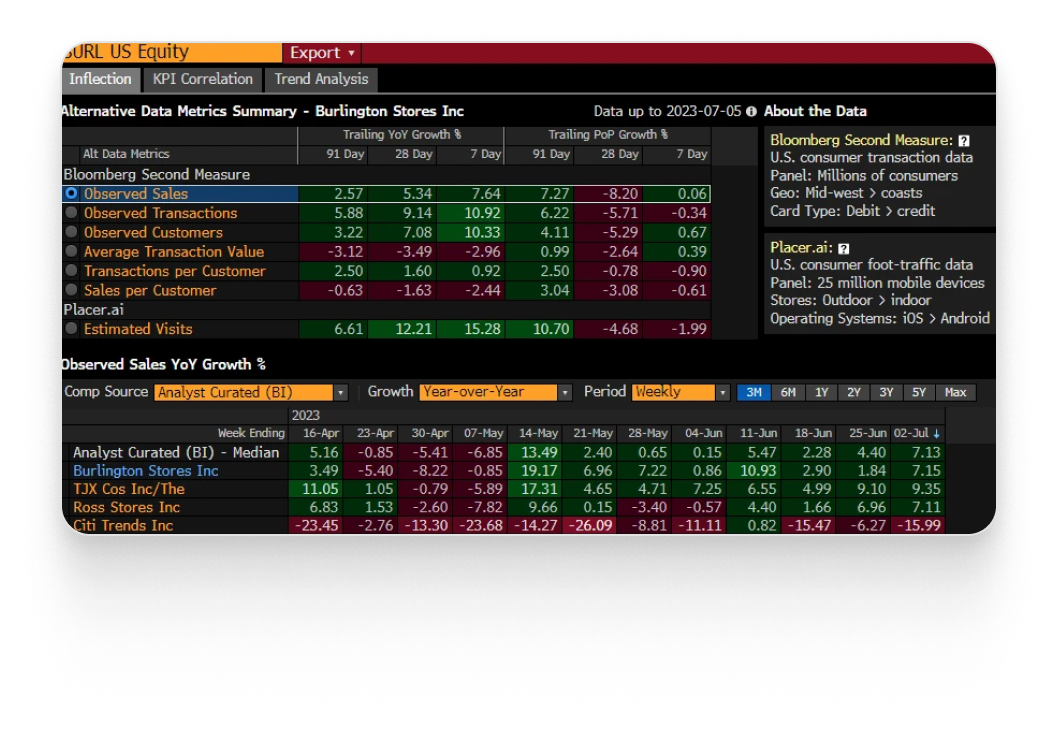

S&P Capital IQ

S&P Capital IQ provides more or less everything Bloomberg does without the execution services or messaging. CapIQ has more private company data and often better fundamentals data quality. Find a comparison between Bloomberg and CapIQ here. CapIQ costs about $25,000 per team. Because CapIQ has team-based pricing it can be a bit easier to share the tool. S&P has many other products, including debt ratings and data feeds, which are all priced separately. Most S&P products have a price point of $15,000 per year or higher.

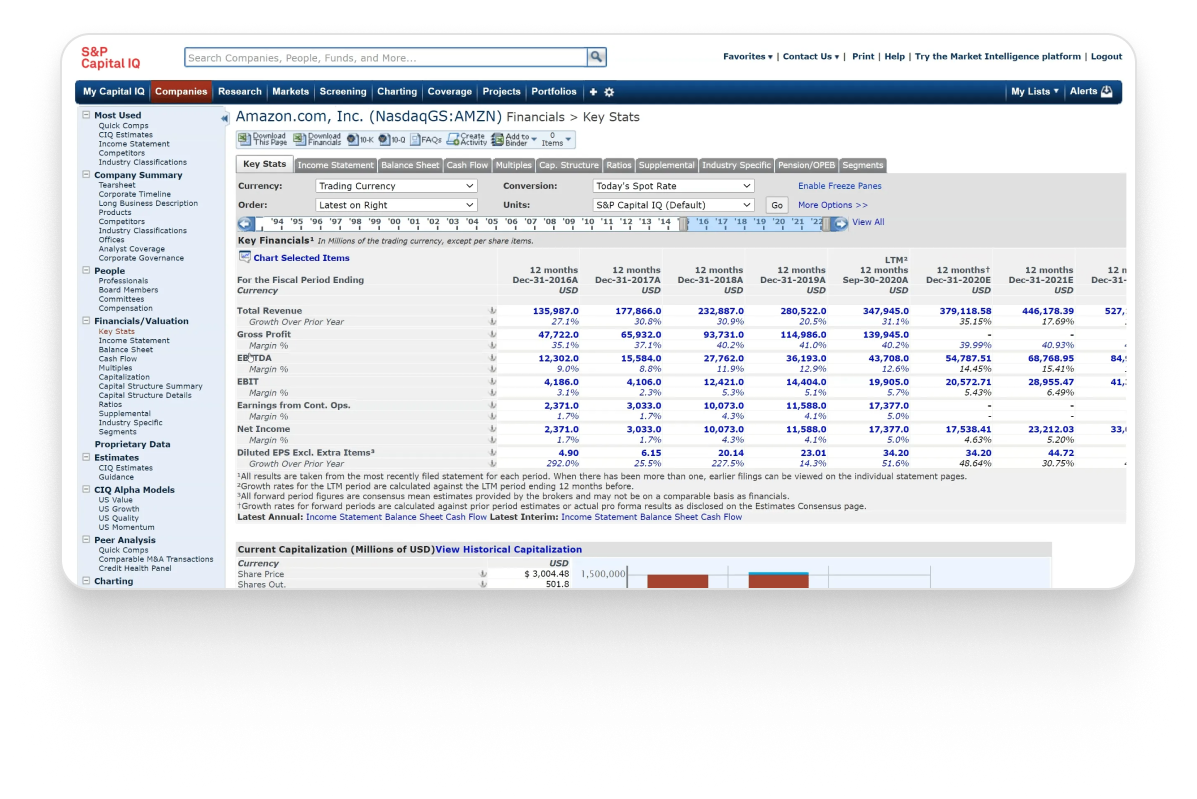

FactSet

FactSet consolidates data on global markets, public and private companies, and equity and fixed-income portfolios. The cost of a FactSet subscription is $12,000 per year for the full product.

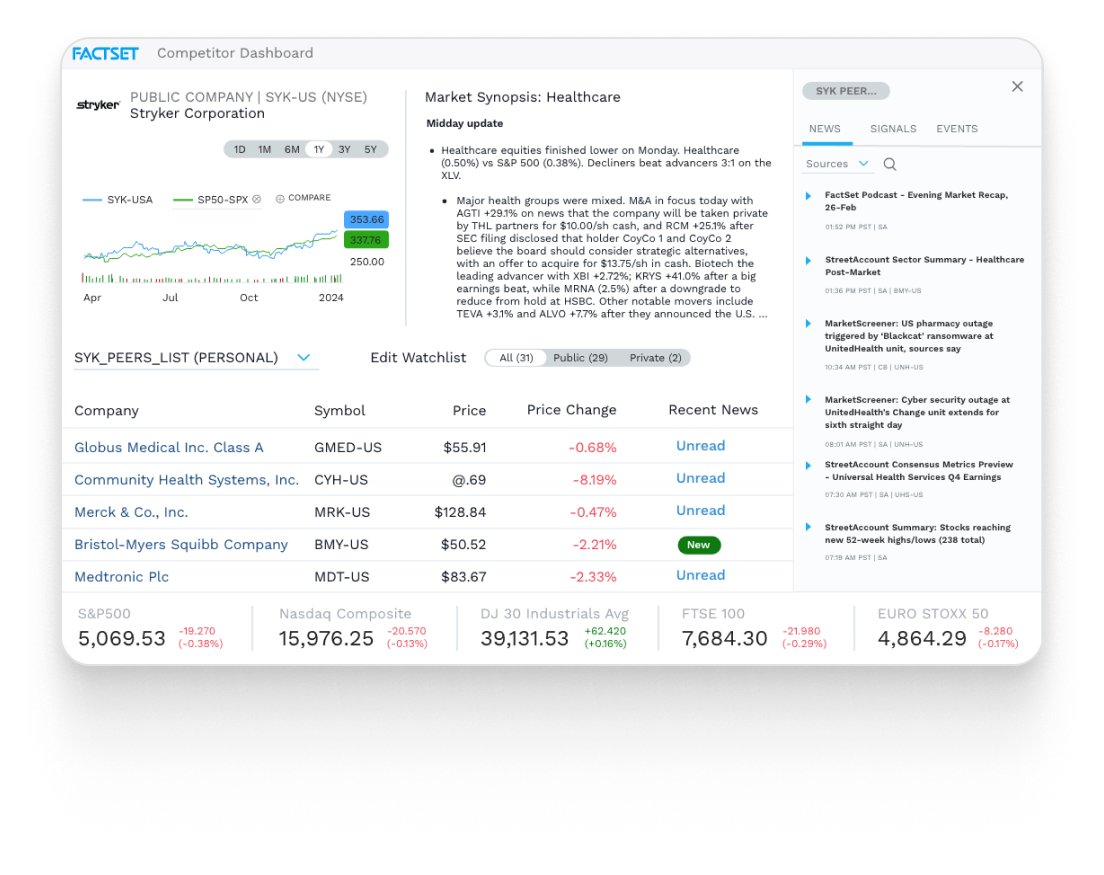

LSEG (formerly Refinitiv Eikon)

LSEG Workspace provides comprehensive coverage of financial data with exclusive access to Reuters news. The cost of LSEG Workspace is $22,000 per year, but a stripped-down version can cost as little as $3,600 per year.

Conclusion

Bloomberg remains a safe, convenient and comprehensive resource, but there are some market data providers that can get you some of the public markets data for a fraction of the cost or free.

While you are here make sure to check out our AI powered software, which will summarize the filings and transcript data for you to save time and make the earnings season and coverage initiation go much smoother.

And if you are interested in other tools that could take your investment analysis workflow to the next level see our complete list of free & paid equity research software and list of 38 AI tools for equity research.