Updated: 12 Sep, 2025

A comprehensive list of the best tools and resources for investment research.

Each year, we update our comprehensive list of the best equity research tools available for both institutional and individual investors. While Bloomberg and FactSet continue to dominate the professional market with all-in-one solutions, their cost (often exceeding $30,000 per seat annually) places them out of reach for many. Fortunately, a growing set of platforms offer powerful, affordable, and even free alternatives.

This year, we’ve not only refreshed existing tools but also added new platforms gaining traction in insider trading monitoring, expert calls, AI-driven research, and filing navigation. To make this more usable, we’ve grouped tools into eight categories:

- Full-Service Market Intelligence Platforms (Bloomberg Alternatives)

- Market Data & Fundamental Analysis

- Forensic Research & Fraud Detection

- Insider Trading & Institutional Ownership Monitoring

- Expert Call Aggregators

- SEC Filing Search & Navigation

- Equity Research Aggregators & Communities

- APIs, Quant Platforms & AI Tools

Summary

1. Full-Service Market Intelligence Platforms (Bloomberg Alternatives)

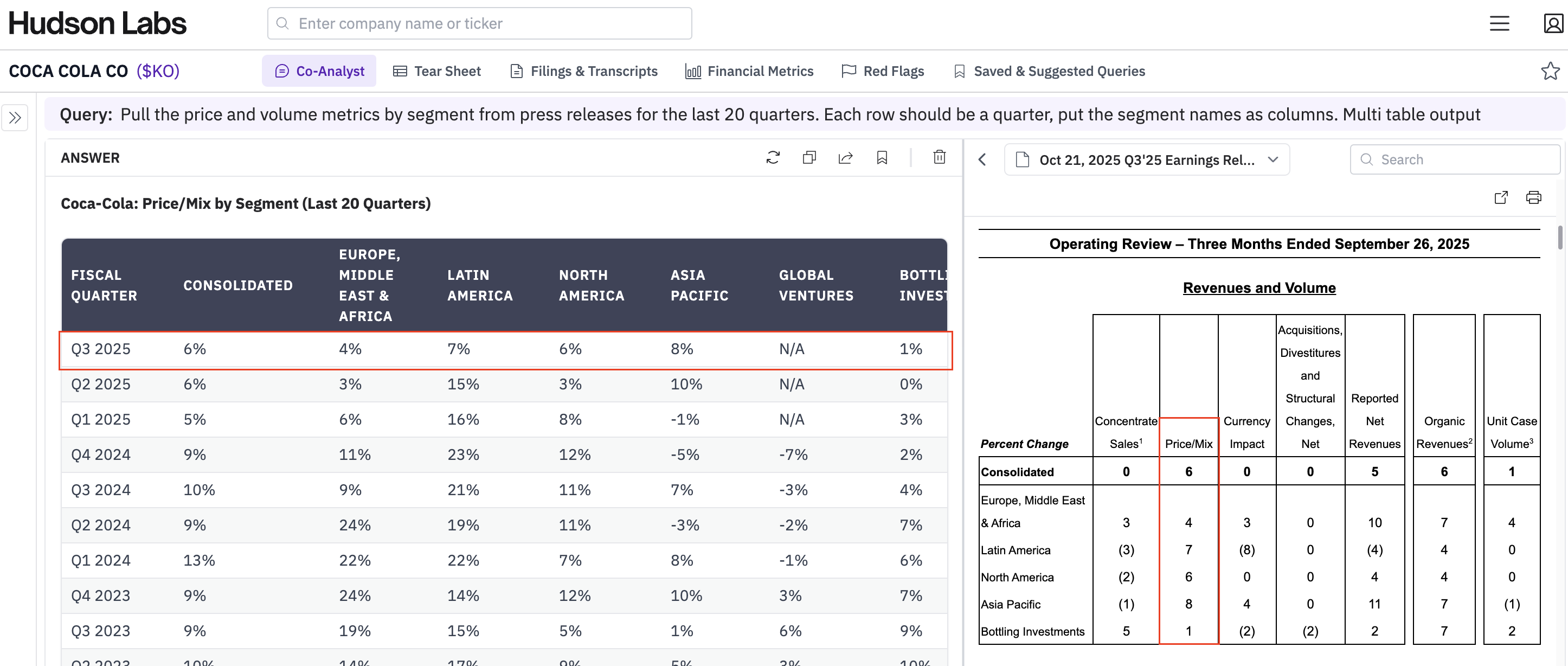

Hudson Labs

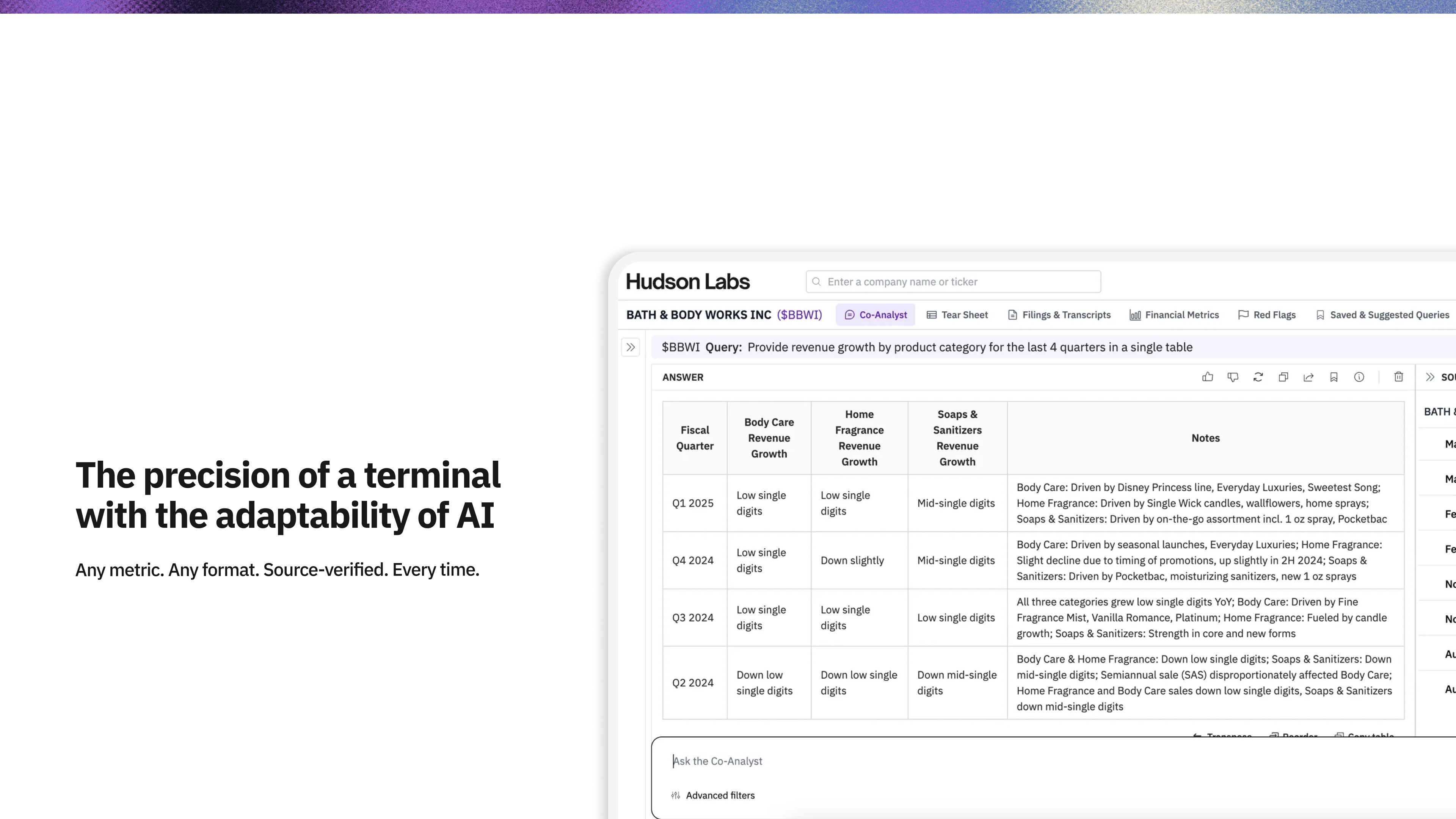

Hudson Labs offers a powerful research platform for investors. The Co-Analyst is a high-precision AI tool built for finance professionals, excelling at KPI extraction, forward guidance parsing, and synthesis across filings, releases, and transcripts. See the launch announcement here.

Key Co-Analyst Features

- The precision of a terminal with the adaptability of AI:

- Any metric, any source, any format

- Turn ‘mid-single digits’ into structured time series

- Link management commentary directly to the numbers

- Get up to speed in 2 hours instead of 2 weeks:

- Key debates and catalysts

- Segment, product and market share trends

- Guidance tracking

- Strategy synthesis and risk assessment

- Ramp up for earnings — in one-third the time:

- Soft guidance captured — every word, every hedge. No missed forward-looking statements, no guesswork.

- All earnings documents, one answer. Filings, releases, decks, transcripts — synthesized so you don’t miss a line.

- Verbatim summaries — no spin, no paraphrase. The most important management statements, word-for-word.

- Interim call tracking — stay current between quarters. Know what changed before you step into earnings.

Trusted by clients managing $1T+ AUM, Hudson Labs Co-Analyst is complemented with S&P-powered market data and our proprietary forensic risk assessment (bankruptcy warnings, control weaknesses, SEC risk, etc.).

Pricing: Starts at $100/month. Start your free trial.

CapEdge (formerly Docoh)

A free platform with SEC filings search, redlining between 10-Ks, alerts, earnings transcripts, IPO info, and institutional holdings. An interface overhaul is expected in 2026.

Pricing: Free.

TIKR

Global equities terminal with 100K+ stocks, 20-year financial history, consensus forecasts, peer comps, and a Valuation Model Builder.

Pricing: Free tier, Plus ($19.95/mo), Pro ($39.95/mo).

Koyfin

Visualization-first platform with 5,900+ filters, advanced charting, portfolio analytics, mobile app, and client-ready reporting.

Pricing: Freemium, paid plans from $39/mo.

2. Market Data & Fundamental Analysis

Hudson Labs

Provides structured financials for 5,500+ U.S. stocks. Go beyond just standard financials and use the Co-Analyst to extract unique KPIs (traffic, average ticket, etc.) and related commentary directly from the earnings transcripts.

Pricing: Core subscription starts at only $100/m. Get a 14-day trial or book a demo to learn more here.

Yahoo Finance

A basic but enduring tool. Provides free quotes, charts, earnings calendars, screeners, and analyst ratings. Premium adds downloadable histories and advanced charts.

Pricing: Free tier available; Premium subscription tiers unlock advanced screeners, premium charts and longer downloadable histories.

ROIC (roic.ai)

Offers 30+ years of financial data, transcripts, and downloadable datasets. Integrates with Google Sheets and ChatGPT, making it attractive for users who want flexible workflows.

Pricing: Free tiers exist for casual use; Professional/API access is available from $40 /mo.

IBorrowDesk

Tracks borrow availability and fees from Interactive Brokers data. Especially useful for short-sellers or those monitoring financing costs.

Pricing: Core data is freely available; offers optional Patreon tiers for an ad‑free experience and additional alert slots.

ShortSqueeze.com

Publishes short interest statistics, short ratio metrics, and squeeze research.

Pricing: Access available for $59.99 /mo or $599.90 /yr.

3. Forensic Research & Fraud Detection

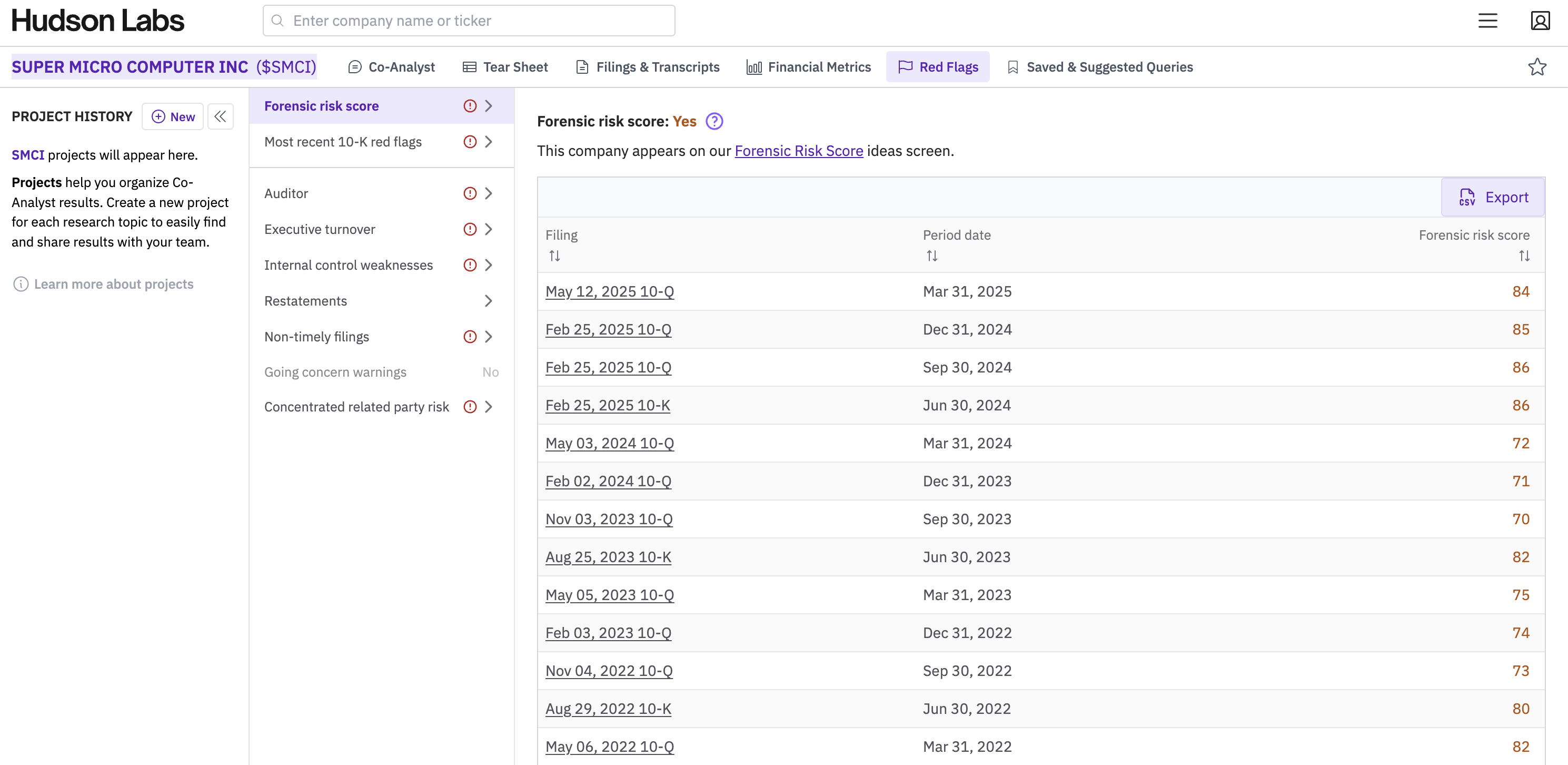

Hudson Labs

AI-driven forensic risk assessment, including going concern warnings, material weakness disclosure, concentrated related party risk, and SEC comment letters.

Check out our blog for more case studies and examples. Find Research and White Papers here.

Pricing: Our forensic risk features are only available on the Institutional tier. Book a demo to learn more.

InsiderScore (VerityData)

Provides clean, verified data on insider transactions, institutional ownership, buybacks, and equity grants. Human-reviewed notes help eliminate false positives, giving investors reliable insights into insider activity and corporate behavior.

Pricing: Unavailable.

Disclosure Insight (Probes Reporter)

Tracks insider trades, institutional ownership, and corporate buybacks, highlighting potential risks through human-reviewed analysis of SEC filings and public disclosures.

Pricing: Free.

ICIJ Offshore Leaks

Provides searchable access to global leaks, including the Panama Papers, Paradise Papers, and Bahamas Leaks, for forensic and compliance research.

Pricing: Free.

Good Jobs First Violation Tracker

Aggregates enforcement records from 200+ federal, state, and local agencies, enabling users to research regulatory compliance and corporate violations.

Pricing: Free to search and view results, but downloads are restricted to paid subscribers. Paid subscriptions start at $25 /mo or $250 /yr.

PACER

Offers access to U.S. federal court records for litigation risk analysis and corporate investigations.

Pricing: Costs $0.10 per page, with fees waived for anyone spending under $30 per quarter.

And more....

Complete list: Forensic stock research resources for finding and avoiding fraud

4. Insider Trading & Institutional Ownership Monitoring

InsiderScore (VerityData)

Offers high-integrity insider trading and related corporate event data (buybacks, equity grants, management changes, etc.). Cleans and parses Form 4 filings, provides analyst-written briefs, standardized feeds for institutional usage.

Pricing: Unavailable.

InsiderBuyStock

(New) Real-time alerts on insider transactions via SEC Form 4 parsing. Tracks and surfaces insider buys/sells soon after disclosure.

Pricing: $9.99 /mo

InsiderTracking.com

Free alerts and reports across U.S. and Canadian markets. Provides “Insider Sentiment Trends” (INK Indicators) – daily survey-like metrics of insider buying vs selling.

Pricing: Free partial access with premium subscription available for $17.99 /mo.

Insiderviz

Interactive dashboards for insider trades (including corporate insiders, U.S. Congress disclosures). Offers screeners, watchlists, real-time alerts, sub-form detail.

Pricing: Basic (free) with core features, and Pro at US $6.75/mo (billed annually ~$81/yr).

InsiderEdge

Tracks trades by insiders, politicians, and “superinvestors.” Offers performance tracking of insider trades over time, real-time alerts, and analytic tools to assess which insiders tend to act ahead of market moves.

Pricing: Free partial access with premium subscription available for $14.99 /mo or $149.99 /yr.

Free alternatives: Broker filings, SEC Form 4 feeds, and tools like Finviz offer basic insider transaction data, though without the depth of InsiderScore. See more here.

5. Expert Call Aggregators

Tegus (AlphaSense)

Offers a large transcript library of expert calls, plus live calls, with BamSEC integration.

Pricing: AlphaSense pricing isn’t publicly available, but we have seen prices in the range of $15,000 - $20,000 per seat per year.

Expert Network Calls (ENC)

Aggregates many expert networks. You can schedule expert calls from different networks through a single platform. Includes transcripts and payment orchestration.

Pricing: There is no subscription cost or prepayment. Clients pay per individual call.

Inex One

Marketplace for expert networks and surveys. Offers access to many networks, unified billing, transcripts and summaries included. You can choose audio or video calls; transcripts are free.

Pricing: Pay-as-you-go pricing. Average expert call rates (for typical experts) are US$1,000-1,250 per hour.

6. SEC Filing Search & Navigation

Hudson Labs

AI-powered navigation of SEC filings. Extracts KPIs, risk flags, and comparative red flags across periods. Users can pull up earnings calls, proxy statements, etc., and query these documents via the Co-Analyst.

Pricing: Core plan starts at just $100 /mo.

AlphaSense

“Smart search” across filings (10-K, 10-Q, 8-K etc.), transcripts, research reports, and news. Advanced filtering, alerts, sentiment features, synonym-based search, and internal/external document integration.

Pricing: AlphaSense pricing isn’t publicly available, but we have seen prices in the range of $15,000 - $20,000 per seat per year.

DisclosureNet (Certent)

Provides access to U.S. and Canadian filings. Designed for compliance, accounting, and legal teams as well as investors. Includes customizable alerts, watchlists, and collaborative review features.

Pricing: Unavailable

inFilings (VerityData)

Focuses on SEC public disclosures: 10-Ks, 10-Qs, proxies, press releases; includes redlines and “diff” tools; filters, alerts, structured data exports; special datasets (incentive compensation, risk factors etc.); summary tools and heatmaps.

Pricing: Unavailable

7. Equity Research Aggregators & Communities

Seeking Alpha

One of the larger sites for crowd-sourced and professional analysis. Articles, earnings reaction, institutional insights, plus author ratings, quant data, dividend and earnings calendars. Good breadth.

Pricing: Has both free content and premium subscription. Premium and Pro subscriptions include access to certain articles, model portfolios, quant ratings, etc., and starting at $299/yr.

Benzinga Pro

Real-time financial news and research platform designed for active traders and investors. It provides fast, customizable newsfeeds, live audio squawk, real-time stock scanners, and AI-powered insights.

Pricing: Basic access starts at $37 /mo.

8. Other APIs, Quant Platforms & AI Tools

Nasdaq Data Link

Provides APIs for traditional financial, economic, and some alternative datasets. Frequently used for backtesting, quant workflows, research.

Pricing: Pricing varies by dataset, with some datasets available for free.

SEC API

Allows querying (real-time or near real-time) of SEC filings, metadata, etc. Better structure and easier access than scraping EDGAR manually. Useful for automating research workflows.

Pricing: Free

OpenBB

Open source research terminal. Includes dashboards, apps, ability to connect data sources, build custom projects, share workflows.

Pricing: Offers both “Community” (free/open source) and “Pro” (paid) tiers, but no pricing details available.

Charli AI

AI-driven investment research tool: summarizes filings, monitors public & private companies, creates reports. Has “Smart Deal Finder” for finding opportunities, comparing companies, tracking sentiment.

Pricing: Free partial access, Professional tier starts at $150/mo.

Looking for more AI tools?

Find our list, including free and low-cost tools here: Top AI Tools for Equity Research

Do you know of an awesome tool that should be added to our list? Our Twitter DMs are open. Let us know!

Find Herb Greenberg’s favourite stock research tools here.

We’ve collected lists of the best financial research software in the following categories:

- Full service financial research software a.k.a.Bloomberg alternatives

- Market data & fundamental analysis

- Forensic research

- Expert call aggregators

- Insider trading & institutional ownership

- SEC filing search & analysis

- Research & financial news aggregators

- Financial APIs

- Quant platforms

- Artificial intelligence and machine learning for stock research