$TWTR, $CELU, $CSII, $GOCO, $BBBY

Filings from the week of May 24 - May 30.

Cellularity Inc. ($CELU) reported substantial doubt in continuing as a going concern and ineffective controls. The company raised $30 million through a PIPE transaction to keep the lights on. TWITTER INC ($TWTR) director Egon Durban tendered his resignation from the board after failing to receive majority votes at the annual shareholders meeting. However, the board did not accept his tendered resignation. TWTR also received a comment letter from the SEC. TWTR's Risk Score has been increasing quarter-over-quarter.

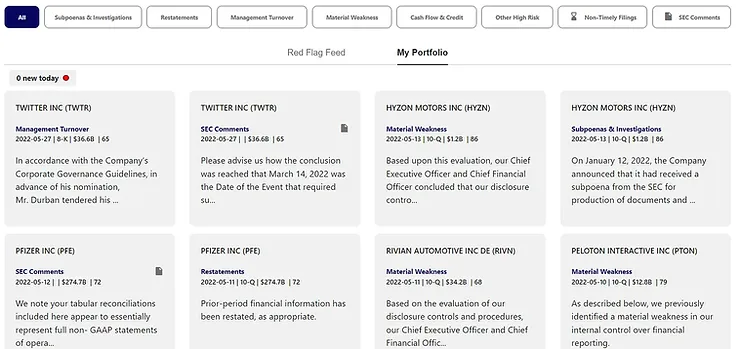

In Case You Missed it: We released real-time news feeds for top red flags on May 31st. Read more about the new feature.

Top Red Flags

TWITTER INC ($TWTR) | 8-K | $30.3B - TWTR announced that Egon Durban has tendered his resignation from the company’s board of directors. His intent to resign came after he failed to receive a majority of votes at Twitter’s annual shareholders’ meeting. Nevertheless, Twitter’s board decided NOT to accept Durban’s tendered resignation, stating that the departure “is not in the best interests of the Company.”

CARDIOVASCULAR SYSTEMS INC ($CSII) | SEC Comment Letters | $663.2M - The SEC notified CSII that the company’s exclusion of In Process Research & Development expenses (IPR&D) from its adjusted EBITDA in its 10-K was inconsistent with SEC’s guidance of Non-GAAP disclosure rules. CSII initially disagreed with the SEC but ultimately stated that it will comply.

GOHEALTH INC ($GOCO) | 8-K | $262M - GOCO received a written notice from Nasdaq notifying that the company did not comply with the minimum bid price requirement of $1.00 per share for 30 consecutive days. GOCO also recently dealt with board and executive resignations. Former board member Helen D. Gayle resigned as of May 25, 2022. The company also lost its former audit committee chair, Anita Pramoda, back in April. GOCO also lost its former CFO, Vance Johnston, back in January.

BED BATH & BEYOND INC ($BBBY) | 8-K | $690.7M - BBBY announced the resignation of its Chief Accounting Officer, John Barresi, “to pursue another opportunity.” Interestingly, Barresi took on this role for only less than a year. BBBY has continued to report decreasing sales in the last three years.

CELULARITY INC ($CELU)

S-1 & 10-Q | Market Cap: $1.3B

Cellularity Inc. ($CELU), a clinical-stage biotechnology company, reported that it has substantial doubt to continue as a going concern [1] despite increasing its Q1 2022 revenues by more than 100% compared to Q1 2021. [2]

CELU has relied heavily on financing from private placement transactions (i.e., PIPE transactions). In FY 2021, CELU received over $83 million from a PIPE transaction. Yet, the company still has going concern issues. Recently, on May 18, 2022, CELU executed another PIPE transaction and received another $30 million. [3]

Not only did CELU report going concern problems, but also the company reported internal control issues. The company stated that its ineffective controls were due to lack of staff competent in finance and accounting as well as incorrect accounting calculations that led to several audit adjustments. [4]

- “We have incurred net losses and used significant cash in operating activities since inception. We have an accumulated deficit of approximately $722.6 million and have cash and cash equivalents of $48.0 million as of March 31, 2022. These factors raise substantial doubt about our ability to continue as a going concern and satisfying our estimated liquidity needs 12 months from the issuance of the financial statements.”

- Per CELU’s Consolidated Statements of Operations for the three months ended March 31, 2022 and March 31, 2021.

- Per CELU’s Form 8-K filed May 20, 2022: “On May 18, 2022, Celularity Inc. (“Celularity”) entered into a securities purchase agreement with an institutional accredited investor providing for the private placement of (i) 4,054,055 shares of its Class A common stock, par value $0.0001 per share (the “Class A common stock”), and (ii) accompanying warrants to purchase up to 4,054,055 shares of Class A common stock, for $7.40 per share and accompanying warrant, or an aggregate purchase price of approximately $30.0 million. The closing of the private placement occurred on May 20, 2022 and was subject to the satisfaction of customary closing conditions.”

- “Specifically, we identified a combination of deficiencies in our internal controls within the financial reporting function, including (i) insufficient internal resources with appropriate accounting and finance knowledge and expertise to design, implement, document and operate effective internal controls around our financial reporting process; (ii) inconsistent and / or incorrect assumptions in our calculation of the contingent consideration liability resulting in identified audit adjustments; (iii) errors in our calculation of deferred tax assets and deferred tax liabilities resulting in identified audit adjustments; and (iv) inconsistent and / or incorrect assumptions in our calculation of the fair value adjustment of warrant liabilities resulting in identified audit adjustments.”

Hudson Labs is a web-based equity research portal. Our software extracts red flags from SEC filings that are predictive of downside risk.

Explore real-time analysis of annual and quarterly statements, 8-Ks, prospectuses, SEC comment letters and more for over 7,000 tickers. Analysis is served without human intervention. Quantamental investing is transforming the industry and Hudson Labs helps you lead the way.

We are not investment advisors, and this is not investment advice. Do your own due diligence.